Two New Insurance Laws for 2024

By Ben Mulvey

When it comes to insurance, many of us wade blindly into the sea of small-print that comes with our policy documents and pray and hope that the companies that we have entrusted to protect us and our assets are keeping an eye on any changes that could affect us. But how do we know about these changes and what are they?

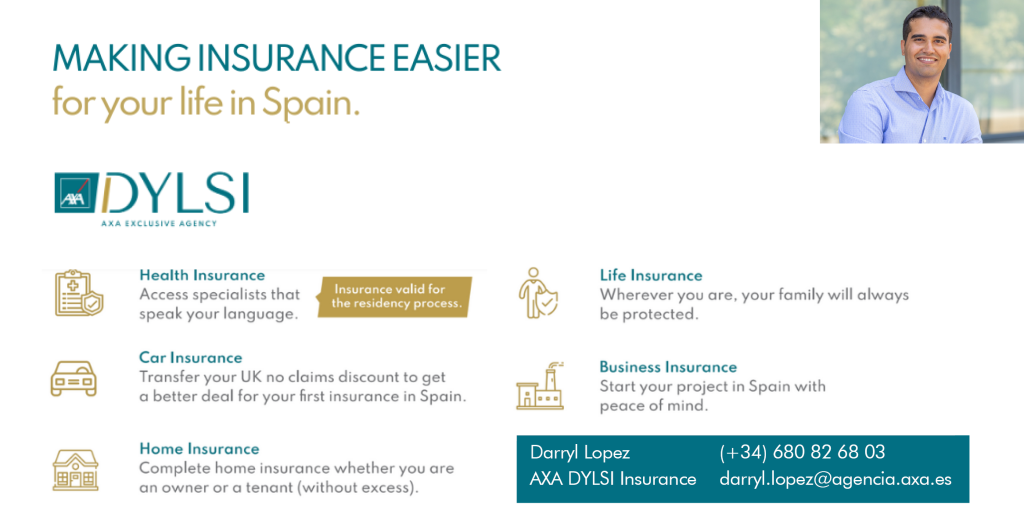

Darryl and his team at AXA DYLSI Insurance have their fingers on the pulse of the insurance market in Spain and recently spoke to me to explain some important legal updates that changed in 2023 with insurance policies that many of us here on the island have.

The first major change concerns those people who have been unfortunate enough to have suffered from cancer. Until recently, cancer patients, even those who had been given the all-clear, often found it difficult to take out insurance policies like life or health insurance. Some insurance companies offered to cover these individuals but with very limited policies that often came with high excesses and in many cases were not issued at all. Even in the case of mortgages, many cancer patients were unable to take out the mandatory life insurance needed for the loan. Considering there are approximately 2.2 million cancer patients in Spain, this is a huge percentage of people being refused insurance policies.

As per an EU directive that was approved and came into force on the 27th of June 2023, cancer patients who have been in remission for five years with no illness or more can not be denied insurance policies. Furthermore, they cannot offer different conditions to other clients including additional costs, excesses or exclusions. This new directive ensures that cancer patients do not remain unprotected and that it is illegal to distinguish between cancer patients and non-cancer patients, or even to ask the question in the first place in the initial insurance questionnaires.

Should someone have an existing policy that has a cancer treatment exclusion or any limitations, they can now request that it be removed or annulled. It is recommended that you speak to your insurance advisor to find out if your coverage has changed or if anything needs to be updated.

The next update concerns our four-legged friends and the Civil Responsibility Insurance that is now mandatory in Spain. On March 29, Law 7/2023 regarding animal rights and welfare protection, the so-called new Animal Welfare Law, was published in the Official State Boletin.

The Spanish Animal Welfare Law is a new law that aims to regulate and control the keeping and treatment of animals throughout Spain through a series of new rules. Its objective, as stated in the official document of the BOE, is to protect animals residing in Spain and to guarantee their welfare.

Although it was already mandatory to have liability insurance for dogs in some Spanish provinces, and mainly for “dangerous breeds”, the Animal Welfare Law stipulates that it will now be mandatory for all dogs in Spain to have third-party liability insurance, to cover any damage they may cause.

No matter its breed or size: from a large and potentially dangerous one to a Chihuahua that crosses the street causing a cyclist to fall, no dog is exempt from causing an unexpected accident.

The law states that it was in effect from September 29th, 2023. However, in the same law in article 30 where it is stated that civil liability insurance for dogs will be mandatory, it is also stated that the limits and details of this insurance will be ‘developed in a subsequent regulation’. This means that the Government will have to publish an extension of that law (regulation) where it will be fully explained as to what the insurance requirements are. This has caused some confusion in the sector as it means that the law is in force, but that the Civil Liability insurance part is not mandatory until the requirements are fully detailed. For this reason, it is recommended that the insurance is taken out ahead of time to avoid any issues when the law is finally published.

Many of us already have home insurance policies that cover damages caused by pets, but it is important to speak to a qualified agent or broker to find out what is covered and ensure that you have the correct policy that is within this new law. AXA also offers standalone Civil Liability Insurance for pets that covers up to 1.2 million euros. The policy covers accidents caused by a pet, and situations that are caused should your dog bite someone or another dog, or property damage. The policy can also be taken out for guide dogs and service animals.

Both of these new laws are important and can save you both time and money when it comes to claims. Darryl and the team at AXA DYLSI will be able to talk you through these new laws, explain how they affect your policies and advise you on how to proceed.

Darryl at AXA DYLSI Insurance is available for any of your insurance needs or queries and speaks both English and Spanish. Speak to your trusted agent or broker to review your insurance situation and any changes that you need to make. Remember family situations, businesses and health conditions can change and therefore your insurance policies must adapt to your situation. Trust your insurance matters to a professional in 2024 and make sure that you and your families are fully protected.